- Get $10,000 in your DEMO account

- Minimum trading amount is $1

- Get up to 98% Rate on Return

- Fast deposits and withdrawals

- $10 minimum deposit

- $10 minimum withdrawal

After hearing about the explosive growth of cryptocurrencies like Bitcoin, I decided to try my hand at crypto investing. My goal was to steadily build a portfolio that could make me financially independent within a few years.

Incredibly, I was able to turn an initial investment of just KSh50,000 into over KSh1 million in profits in under 18 months.

Here, I outline my exact strategy and key lessons learned while pursuing crypto wealth from Kenya. With the right mindset and disciplined approach, you too can achieve financial freedom through crypto.

Starting With Strong Foundations

Before investing a single shilling into crypto, I spent months learning about blockchain technology, Bitcoin, and the overall digital asset market.

I read books, listened to podcasts, watched YouTube videos, and joined Telegram groups. I didn’t want to blindly jump in without understanding this new digital money paradigm.

- Get $10,000 in your DEMO account

- Minimum trading amount is $1

- Get up to 98% Rate on Return

- Fast deposits and withdrawals

- $10 minimum deposit

- $10 minimum withdrawal

Some key mindset principles that prepared me included:

- Long-term, buy-and-hold strategy – I knew crypto was volatile and could drop sharply in the short-term. My mindset was to hold for 5+ years, not try to time daily fluctuations.

- Dollar-cost averaging – Instead of investing in a lump sum, I deployed my capital systematically over many small buys. This smoothed out price volatility.

- Portfolio diversification – Bitcoin was my core holding, but I also bought major altcoins and stablecoins to manage risk.

- SECURITY – I used hardware wallets, private keys, multi-sig, and layers of encryption to keep my crypto secure. Losing keys meant losing access, so security was paramount.

With the right mental models, I felt ready to embark on my crypto investing journey.

Starting Small with KSh50,000

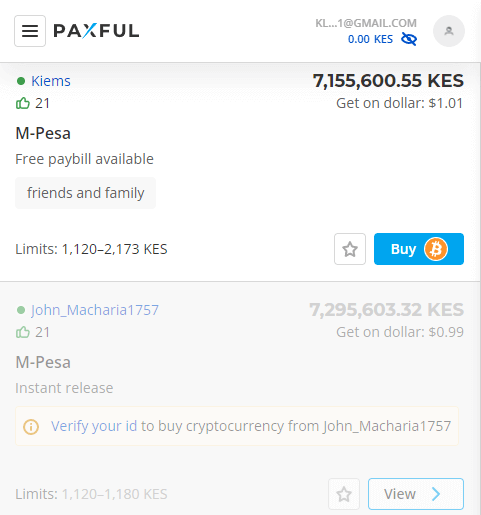

In March 2021, I accumulated my starting capital by depositing KSh50,000 from my bank account into a popular Kenyan crypto exchange called Paxful.

I went through full KYC and chose an exchange with solid security practices.

I started by purchasing a core position of Bitcoin and Ethereum:

- Bitcoin (BTC) – KSh25,000 (0.0015 BTC at ~$20,000 per BTC)

- Ethereum (ETH) – KSh15,000 (0.35 ETH at ~$1,400 per ETH)

The rest I kept in stablecoins (USDT) to hedge against volatility and to trade altcoins. My total starting portfolio value was ~KSh50,000.

Executing My Dollar-Cost Averaging Plan

With my core BTC and ETH positions established, I began a systematic DCA (dollar-cost averaging) plan on Paxful.

Every 2 weeks on payday, I would:

- Deposit KSh5,000 from my bank into stablecoins

- Use 50% to buy BTC, 25% for ETH, 25% to trade altcoins

This regular buying meant I steadily accumulated more satoshis (fractions of BTC) over time regardless of price. Whenever the market dipped, my buys got me more crypto for the same KSh amount.

Trading Altcoins for Short-Term Profits

To supplement my long-term holds, I also traded smaller cap altcoins through Binance and PancakeSwap. These more speculative assets offered explosive upside, albeit with higher risk.

- Get $10,000 in your DEMO account

- Minimum trading amount is $1

- Get up to 98% Rate on Return

- Fast deposits and withdrawals

- $10 minimum deposit

- $10 minimum withdrawal

My altcoin trading rules included:

- Hold BTC/ETH core, trade alts around it

- Target 3-5x short term gains

- Cut losers quickly, let winners ride

- Move profits back into BTC/ETH

These rules allowed me to increase my core Bitcoin and Ethereum holdings by trading altcoin volatility.

Some winning trades included:

- Bought MATIC at KSh5, sold at KSh15 (+200%)

- Bought AAVE at KSh10,000, sold at KSh28,000 (+180%)

- Bought DOGE at KSh0.50, sold at KSh2 (+300%)

These 3-5x wins accumulated rapidly, allowing me to grow my holdings substantially.

Managing Security and Risk

As my crypto portfolio grew into the hundreds of thousands, security became paramount. Here are some best practices I followed:

- Used hardware wallets (Ledger, Trezor) to secure private keys

- Stored seed phrase backups securely in safe deposit boxes

- Used complex passwords and 2FA everywhere

- Joined a crypto insurance program for added protection

- Limited account balances on exchanges to minimize risk

- Diversified across assets uncorrelated to crypto (real estate, stocks)

No security setup is foolproof, but combining hardware wallets, backups, encryption, diversification, and insurance gave me confidence.

The Crypto Bull Market Accelerates Growth

After getting started in early 2021, I fortuitously benefited from the massive 2021 crypto bull market that took off that summer.

As corporations like Tesla bought Bitcoin, and adoption exploded, my portfolio rapidly appreciated:

- Bitcoin went from ~$20k to ~$60k by November 2021

- Ethereum went from ~$1,400 to ~$4,600 by November 2021

My systematic DCA strategy meant I was steadily accumulating BTC and ETH even as prices rose. By Q4 2021, my crypto holdings had climbed to over KSh1 million in value.

This period taught me the power of multi-year bull markets in maximizing returns. Timing is often underappreciated in financial success.

- Get $10,000 in your DEMO account

- Minimum trading amount is $1

- Get up to 98% Rate on Return

- Fast deposits and withdrawals

- $10 minimum deposit

- $10 minimum withdrawal

Lessons Learned Turning KSh50,000 into Over KSh1 Million

In just 18 months, my portfolio grew over 20x, far exceeding my expectations. Here are key lessons I learned during this wild crypto ride:

- Have a plan and stick to it – My DCA and long-term holding strategy worked excellently through volatility

- Security first – Lose your keys, lose your coins. Take security seriously from day one.

- Keep learning – Crypto evolves rapidly. Stay humble and keep absorbing information daily.

- Mindset matters – Don’t panic sell in fear. Have conviction in your holdings and strategy.

- Diversify – Balance safer assets like BTC with calculated risks like altcoins and DeFi.

- Enjoy the ride – Crypto is an exciting space. Stay balanced and enjoy participating in this technological revolution.

The crypto market is always evolving, but starting small, educating myself, and sticking to a plan helped unlock life-changing wealth I never imagined possible.

My crypto portfolio has given me financial freedom, security for my family, and a ticket to financial independence. The future is bright, on-chain!

- Business To Start With 10K in Kenya: Ideas + Guide

- They Told Me I’d Never Be More Than a House Girl – Now I Own a KSh 5M Cleaning Company

- Quit My KSh150k Job Because My Mean Boss Refused to Give Me Leave – Best Decision I Made

- They Laughed When I Left Class 8 – But My Nairobi Salon Business Now Employs 50 Staff

- Quit My KSh 30K Office Job to Sell Samosas Online – Now I Earn 6 Figures Monthly

- Get $10,000 in your DEMO account

- Minimum trading amount is $1

- Get up to 98% Rate on Return

- Fast deposits and withdrawals

- $10 minimum deposit

- $10 minimum withdrawal